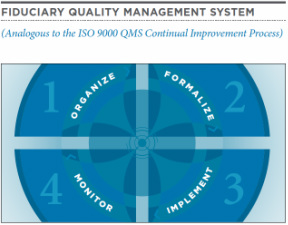

Fi360’s practical framework ensures investment strategy is being properly developed, implemented, and monitored to meet both legal and ethical obligations.

Whether one is trustee of a family trust, on the board of a charity or a director of a superannuation entity, the legislation in NZ and Australia is making it increasingly clear that there must be an investment governance framework in place. Minimum components should include;

The benefits of defined Fiduciary Practices when applied by both trustees and their advisers should include;

Whether one is trustee of a family trust, on the board of a charity or a director of a superannuation entity, the legislation in NZ and Australia is making it increasingly clear that there must be an investment governance framework in place. Minimum components should include;

- clarity of everyone's roles, services and responsibilities, including providers

- an investment policy statement (IPS), setting out all governance processes and policies

- a clear strategy to meet objectives and appropriately diversify assets

- the due diligence procedures used and records of findings

- an investment performance reporting approach that facilitates meaningful decisions

- a review process to ensure that the investment governance framework remains effective

The benefits of defined Fiduciary Practices when applied by both trustees and their advisers should include;

- providing evidence that a prudent investment process is in place

- avoiding omissions through practical checklists

- establishing an educational basis that builds confidence and trust

- delivering improvements in investment performance

- validating and controlling the many costs involved in investment